I feel your pain. I’ve been there, and I know the feelings of fear and desperation you’re experiencing, but rest assured that as long as you are willing to come up with a plan and stick to it there is hope. For years you have been living large on revolving credit. Instead of waiting to actually get paid on your accounts receivable, you gone right out and spent the money using a device called commercial paper with the intent of paying it back when the checks clear. Of course, by the time that happens, you’ve already spent more money, so you’re stuck in a constant game of catch up. It’s not a problem until one of two things happen, either some of your debtors fail to pay or some of your creditors fail to extend you credit. Both of those have happened, and now you’re stuck in the middle.

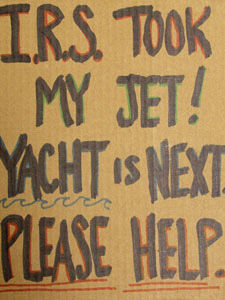

I feel your pain. I’ve been there, and I know the feelings of fear and desperation you’re experiencing, but rest assured that as long as you are willing to come up with a plan and stick to it there is hope. For years you have been living large on revolving credit. Instead of waiting to actually get paid on your accounts receivable, you gone right out and spent the money using a device called commercial paper with the intent of paying it back when the checks clear. Of course, by the time that happens, you’ve already spent more money, so you’re stuck in a constant game of catch up. It’s not a problem until one of two things happen, either some of your debtors fail to pay or some of your creditors fail to extend you credit. Both of those have happened, and now you’re stuck in the middle.You’re not alone. This has happened to millions of middle-class Americans who’ve been living on credit cards, home equity loans, and have suffered a job loss, accident, illness, hiked interest rates, or like me simply came to the realization that their situation was unsustainable. They’ve had to suck it up and deal with it without a government handout, and you can too. The solution is surprisingly simple:

- Cancel your tee time and sit down with your CFO. Figure out how much money you have coming in (not projections or accounts receivable, but actual cash) and then list your expenses. Prioritize your expenses and develop a written budget which pays those critical items first: Payroll, rent, utilities, etc. on down the list to less important stuff like donations to the RNC and massaging desk chairs with happy endings.

- Now decide which expenses you can cut without hurting productivity in the long term. While any time is a good time to trim dead wood, make sure you don’t cut anyone who actually makes you money or provides a valuable service. It’s easy to fire a long-time janitor and subcontract with a minimum wage cleaning service, but nobody likes sticky restroom floors and empty toilet paper dispensers. Sure you can save a few bucks in the short run by moving your plant to China, but if your quality suffers you’re going to lose repeat customers. Think long term. I know it’s inconvenient to fly coach, but are you really getting a return on investment with that company jet? It’s a luxury, and luxuries have to go.

- Next, figure out ways to increase your income. Listen to the people on the shop floor or out in the field. They often know a lot more about how to improve the product or service than you do. As an incentive, reward them if their ideas improve sales and productivity, but don’t punish them if the idea doesn’t work or no one will dare stick their neck out. Don’t get complacent doing things the same old way, but avoid cutting corners. Fall for either of those temptations and your competition will eat you alive.

- Once you’re making a real profit you’ll be able to build up enough cash so that you won’t need to keep borrowing money just to pay the bills. Pay off your creditors and don’t ever borrow money again. Seriously, if you've made it this far in business and can't afford to cash-flow your expenses, then you might as well throw in the towel.

I know it may sound presumptuous for a young guy with a modest income to say this, but if I managed to get out of the cycle of revolving debt, then you can too. Now quit your fucking bitching.

3 comments:

Or they could just go kill themselves.

That would be item #2 on the list.

Touché.

Post a Comment