The world's erection orgy continues with a new structure taking the undisputed title of "World's Tallest Building". At 141 stories and 508 meters, Burj Dubai beats all comers in each of four categories:

The world's erection orgy continues with a new structure taking the undisputed title of "World's Tallest Building". At 141 stories and 508 meters, Burj Dubai beats all comers in each of four categories:The council measures height to the structural top, the highest occupied floor, to the top of the roof, and to the tip of the spire, pinnacle, antenna, mast or flag pole.And it's not even finished.

The final height and number of storeys, a topic of enthusiastic debate among media and experts alike, has not yet been revealed.Plus it has set another record:

...for vertical concrete pumping for a building by pumping to over 460 metres (1,509 ft). The previous record of 448 metres (1,470 ft) was held by Taipei 101.Damn, that's a lot of pumping.

This is the third new building in the last decade to claim the honor, all three in Asia, with plenty more are on the drawing board. While these structures are fascinating from an engineering standpoint (less so, aestheticly or funtionally), what truly piques my interest is the historical pattern of tower building in relation to economic growth. The latest spurt began in Malaysia, just as the Southeast Asian bubble burst. The previous one was in the late 1960s and early 1970s, and the one before that was in the early 1930s. Each appears to follow the climax of a major economic boom. However, by the time the doors open, the mood is gone, the economy in shambles, and they stand as stark and empty reminders of man's hubris.

In the end, they often lose money, not so much as a result of a downturn, but because of the initial impulse to build them in the first place. From an investment standpoint, even in astronomic real estate markets like Manhattan, Hong Kong or Taipei, the cost of such extreme engineering far exceeds the cost of buying enough land to build two or three 100 to 200 meter towers with equivalent leasable space and impressive views. It's no coincidence that one of the hottest markets, London, home to the Adam Smith Institute, has nothing which even comes close. Why? The numbers just don't compute. In such locales as Kuala Lumpur and Dubai where there is plenty of room for growth, the reasoning is downright preposterous.

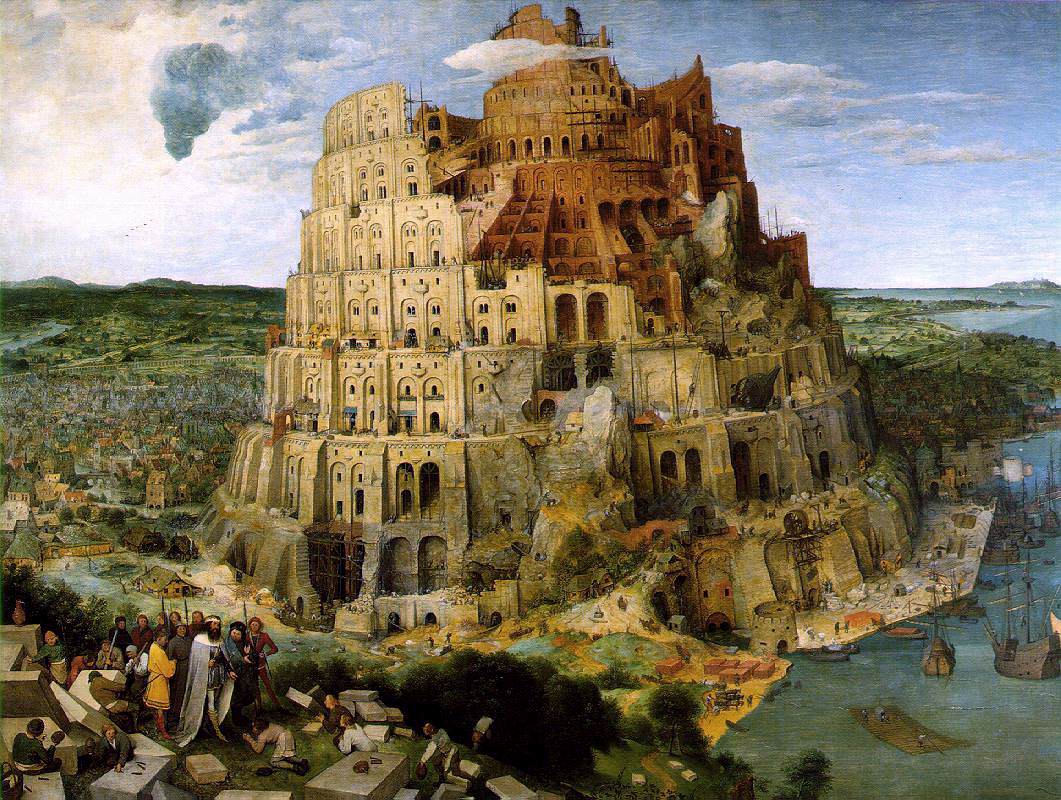

In the end, they often lose money, not so much as a result of a downturn, but because of the initial impulse to build them in the first place. From an investment standpoint, even in astronomic real estate markets like Manhattan, Hong Kong or Taipei, the cost of such extreme engineering far exceeds the cost of buying enough land to build two or three 100 to 200 meter towers with equivalent leasable space and impressive views. It's no coincidence that one of the hottest markets, London, home to the Adam Smith Institute, has nothing which even comes close. Why? The numbers just don't compute. In such locales as Kuala Lumpur and Dubai where there is plenty of room for growth, the reasoning is downright preposterous. No, these buildings are not emblematic of prosperity. Instead, they represent little more than monuments to one's own perceived financial virility, or in the case of many, including the original taxpayer funded World Trade Center and it's slated replacement, the Freedom® Tower, display one's ability to woo the public. It's a story as old as the myth of the Tower of Babel.

No, these buildings are not emblematic of prosperity. Instead, they represent little more than monuments to one's own perceived financial virility, or in the case of many, including the original taxpayer funded World Trade Center and it's slated replacement, the Freedom® Tower, display one's ability to woo the public. It's a story as old as the myth of the Tower of Babel.It will be interesting to see how this pattern plays out in the booming petrocracy of Dubai. Mainland China is in the midst throwing up hyper-towers of its own as well, and while none are currently in contention for the top spot, I suspect that it is only a matter of time until they too fall to temptation.

No comments:

Post a Comment